Are Mortgage Rates Going to Increaase Again in 2018?

Mortgage charge per unit forecast for next week (March 28-April i )

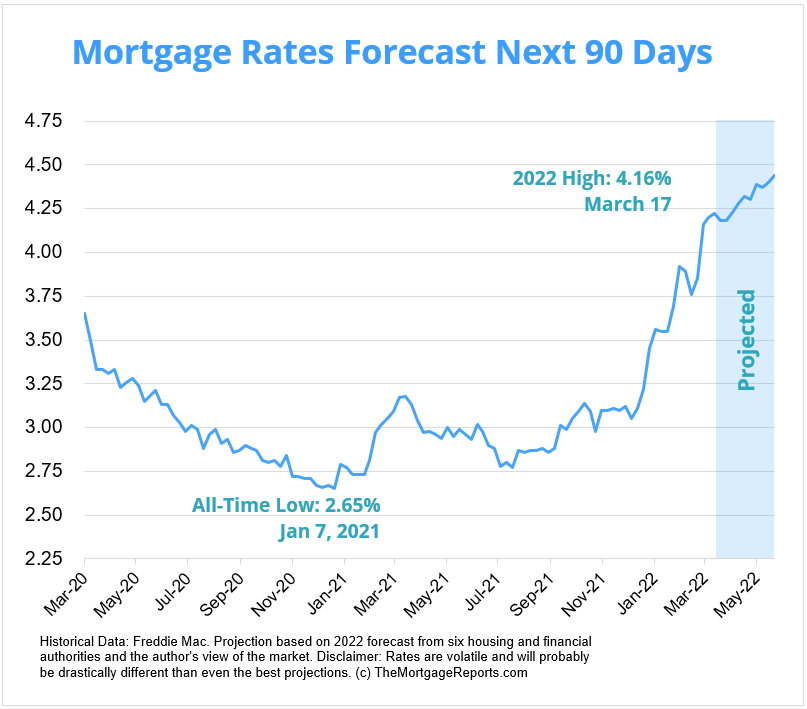

With historically loftier inflation pervading the economic system, mortgage rates broke the four% threshold for the first fourth dimension since 2019.

The average 30-year fixed interest rate spiked from 3.85% on March x to iv.16% on March 17 post-obit news from the Federal Reserve Open Market Commission meeting.

Although the war in Ukraine stirs uncertainty within global markets, most signs point to further mortgage rate growth throughout the year. This makes it probable that you lot should endeavor and lock in a charge per unit sooner rather than later on.

In this article (Skip to...)

- Will rates get down in April?

- 90-day forecast

- Expert rate predictions

- Mortgage rate trends

- Rates past loan blazon

- Mortgage strategies for April

- Mortgage rates FAQ

>Related: Cash-out refinance: All-time uses for your home equity

Will mortgage rates go downwardly in April?

Mortgage rates grew significantly to begin 2022, surging nearly 100 ground points (1.0%) through the start quarter.

With the pandemic's touch on the economy dwindling, inflation at twoscore-year highs and the Federal Reserve tightening its monetary policies, more growth could be in store next calendar month

Experts from Fannie Mae, NAR, Redfin, and other industry leaders think 30-twelvemonth mortgage rates could go as high as 4.five% in April. And none expect them to stay beneath four% for any sustained period.

Of course, the war in Europe or a spike from a new Covid variant could crusade interest rates to fall or add variance.

"Information technology wouldn't stupor me if we laissez passer 4.25% or even become to four.v% this month, depending on how the market starts pricing in what the Fed says."

—Doug Duncan, SVP and primary economist at Fannie Mae

Doug Duncan, SVP and chief economist at Fannie Mae

Prediction: Rates volition rise

"The path is going to be upwards. How much depends on a whole bunch of factors. The Fed signaled they're going to heighten [its fed funds charge per unit target] every time they meet this year.

Now there's chatter about whether the Fed will exist even more aggressive and exercise a 50 footing point increment at the next meeting. It's also not unreasonable to think they might exercise a 50 footing betoken increase and then not do one in the fall as they're watching the runoff of the portfolio.

But information technology wouldn't stupor me if we pass 4.25% or even get to iv.5% this calendar month, depending on how the market starts pricing in what the Fed says. The central will be the release of the [FOMC March] minutes, which come out 3 weeks later the coming together. Powell specifically told reporters get look at the minutes because they will contain details on the runoff of the portfolio. When those minutes come out, I would look there to be some sort of market reaction."

Nadia Evangelou , senior economist and director of forecasting at National Clan of Realtors

Prediction: Rates will rise

"While the next few weeks volition be unpredictable as markets continue to churn, the outlook is for mortgage rates to rise even college. The Federal Reserve indicated six more interest rate increases by the end of the yr. Notwithstanding, inflation will eventually start slowing down sometime later this year.

The Federal Reserve forecasts inflation to average iv.3% in 2022. Thus, I wait some of this impact to exist mitigated eventually through lower inflation. I forecast mortgage rates to average around iv.4% at the cease of the year.

Mortgage rates volition likely hover around 4.2% in April. Inflation will go on to remain elevated while higher short-term interest rates will put upward force per unit area on mortgage rates next calendar month."

Selma Hepp , deputy chief economist at CoreLogic

Prediction: Rates volition vary

"While the rates are likely to exist college by the end of the year, the path of the increase is less certain.

There has already been a notable bound in rates in contempo weeks as a upshot of the disharmonize in Ukraine and the FOMC proclamation. However, some of that increment may subside given the widening spread between mortgage rates and treasuries."

Joel Kan , acquaintance vice president, industry surveys and forecasts at Mortgage Bankers Clan

Prediction: Rates will ascension

"Our economic outlook reflects the potential for slower but still stable economic growth and a healthy job market. The economy remains strong but a renewed tour of supply-chain constraints and disruptions stemming from the state of war in Ukraine is likely to push inflation college.

"MBA forecasts that mortgage rates volition ascent further over the next year to effectually 4.5%. Mortgage rates have been uncommonly volatile in recent weeks, given the profound uncertainties both with respect to the geopolitical situation and budgetary policy. Hopefully, the Fed's deportment of raising its brusk-term charge per unit target for the first fourth dimension since 2018 and explanations can help to reduce the policy uncertainty and rate volatility."

Odeta Kushi , deputy chief economist at Outset American

Prediction: Rates will rise

"Mortgage rates are notoriously hard to forecast because they're tied to the wider economic system and global geopolitical events. The ongoing Russia-Ukraine conflict continues to insert an element of uncertainty into financial markets, which could result in downward force per unit area on mortgage rates.

But the general expectation is that mortgage rates are trending upwards and have already increased based on the expectation of the Fed tightening monetary policy this yr.

Expect mortgage rates to continue to rise in April, but nosotros could see some calendar week-to-week volatility equally Fed tightening, among other factors, propels rates forward, while geopolitical doubt may anchor rates temporarily."

Taylor Marr , deputy main economist at Redfin

Prediction: Rates volition rising

"Redfin'due south expectation is that rates will go along to rise steadily through April — to perhaps 4.4% past the end of the calendar month. This will happen as investors wait the Fed to put upwards pressure level on mortgage rates via winding down their roughly $9 trillion residual sheet of both treasuries and mortgage backed securities in 2022.

Information technology'south worth noting that Jerome Powell said this week that they could begin that process as early every bit May, but more details will be released in the Federal Open Market Committee minutes in early Apr. While there may be global events that could annul this rise, such as the war in Eastern Europe and new variants of COVID-nineteen spreading in Asia, the likely picture is that we won't see rates under four% anymore. The chance of rates increasing xx-xxx basis points by the terminate of April is only growing."

Rick Sharga , executive vice president at RealtyTrac

Prediction: Rates will ascent

"Inflation, Fed actions, and rising yields on U.Due south. Treasuries all indicate towards mortgage rates increasing in April.

Inflation is unlikely to come down in the short term, every bit free energy prices continue to rise and we're likely to see more supply chain disruption due to a new widespread COVID-19 outbreak in China and Russian federation'south invasion of Ukraine.

And somewhat surprisingly, rates on the x-Year U.S. Treasury in mid-March hitting their highest point since June of 2019 at 2.187%. This increment runs counter to the notion that a "flight to safety" during volatile times would bulldoze treasury prices up and yields down. And since there's commonly about a two-point spread between Treasury yields and 30-twelvemonth mortgage rates, that suggests we could run across mortgage rates every bit loftier every bit 4.0%-four.25% during Apr."

Mortgage interest rates forecast adjacent 90 days

Aside from the Russian-Ukrainian conflict's doubt or the next wave of Covid bringing back restrictions, all other major indicators indicate to mortgage rate growth.

The nigh probable effect will be average involvement rates on an overall uptrend in the next iii months. Of grade, they have high volatility and rarely go in a straight line from week to week so we could see some drops mixed in also.

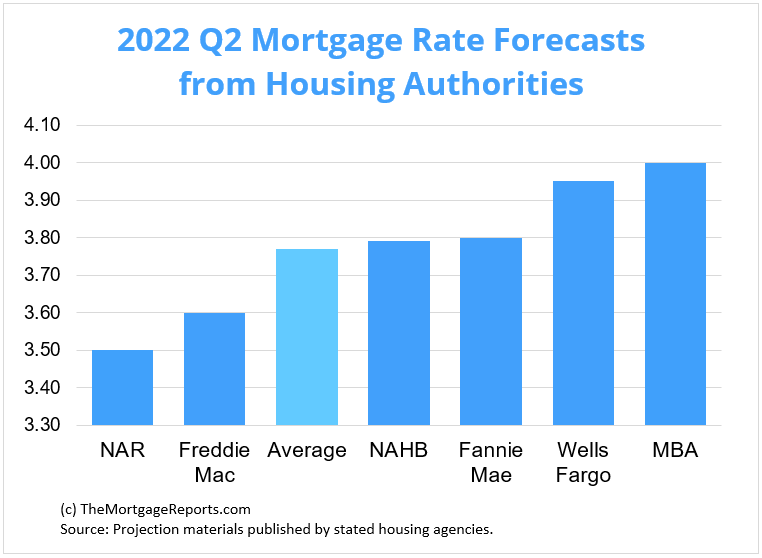

Mortgage rate predictions for 2022

The average 30-twelvemonth fixed rate mortgage ended 2021 at three.1%, according to Freddie Mac.

All 6 of the major housing authorities we gathered project that average to rise over the 2d quarter of 2022.

The National Association of Realtors and Freddie Mac sit at the depression cease of the group, estimating the average 30–year fixed interest rate to settle at three.v% or three.6% past the end of Q2. Wells Fargo and the Mortgage Bankers Association had the highest predictions, with forecasts of iii.9% and 4.0%, respectively, by the end of June.

| Housing Authorization | thirty-Year Mortgage Rate Forecast (Q2 2022) |

| National Association of Realtors | 3.fifty% |

| Freddie Mac | 3.60% |

| National Clan of Home Builders | 3.79% |

| Fannie Mae | three.80% |

| Wells Fargo | 3.90% |

| Mortgage Bankers Association | 4.00% |

| Boilerplate Prediction | three.77% |

Electric current mortgage interest rate trends

Mortgage rates saw huge growth in 2022's opening quarter and shot up to three-year highs.

The average thirty-yr fixed rate surged from 3.85% to 4.16% for the seven days ending March 17, according to Freddie Mac's weekly rate survey.

Similarly, the 15–year stock-still rate jumped from 3.09% to iii.39%, while the boilerplate rate for a 5/1 ARM rose from ii.97% to 3.19%.

| Calendar month | Average 30-Year Stock-still Rate |

| March 2021 | 3.08% |

| April 2021 | 3.06% |

| May 2021 | 2.96% |

| June 2021 | 2.98% |

| July 2021 | two.87% |

| August 2021 | 2.84% |

| September 2021 | ii.90% |

| October 2021 | 3.07% |

| Nov 2021 | 3.07% |

| December 2021 | 3.10% |

| January 2022 | iii.45% |

| February 2022 | 3.76% |

Source: Freddie Mac

Mortgage rates are moving away from the record–low territory seen in 2020 and 2021 but are however low from a historical perspective.

Dating back to Apr 1971, the fixed 30–year involvement rate averaged 7.79%, according to Freddie Mac.

So if you lot oasis't locked a rate yet, don't lose too much sleep over information technology. Y'all can still get a great deal — especially for borrowers with strong credit.

Only make certain you shop around to find the best lender and lowest rate for your unique situation.

Mortgage rate trends by loan type

Many mortgage shoppers don't realize there are dissimilar types of rates in today's mortgage market.

But this noesis can help home buyers and refinancing households find the best value for their state of affairs.

Post-obit are 3-month mortgage rate trends for the most popular types of home loans: conventional, FHA, VA, and jumbo.

| February 2022 | January 2022 | December 2021 | |

| Conforming Loan Rates | 4.09% | 3.77% | 3.35% |

| FHA Loan Rates | 4.11% | 3.86% | 3.45% |

| VA Loan Rates | 3.77% | 3.56% | iii.02% |

| Jumbo Loan Rates | three.76% | 3.45% | 3.23% |

Source: Blackness Knight Originations Market place Monitor Report

Which mortgage loan is all-time?

The best mortgage for y'all depends on your financial state of affairs and your goals.

For instance, if you want to buy a loftier-priced domicile and yous have great credit, a jumbo loan is your best bet. Colossal mortgages permit loan amounts above conforming loan limits — which max out at $647,200 in most parts of the U.S.

On the other hand, if you lot're a veteran or service member, a VA loan is almost always the right choice.

VA loans are backed past the U.Due south. Department of Veterans Affairs. They provide ultra-depression rates and never charge private mortgage insurance (PMI). But yous need an eligible service history to qualify.

Befitting loans and FHA loans (those backed by the Federal Housing Administration) are bang-up depression-down-payment options.

Conforming loans let equally fiddling every bit 3% downwards with FICO scores starting at 620.

FHA loans are even more lenient about credit; home buyers can oftentimes authorize with a score of 580 or college, and a less-than-perfect credit history might not disqualify yous.

Finally, consider a USDA loan if you want to buy or refinance existent estate in a rural surface area. USDA loans have beneath-market rates — similar to VA — and reduced mortgage insurance costs. The catch? Yous demand to live in a 'rural' area and have moderate or low income to be USDA-eligible.

Mortgage charge per unit strategies for April 2022

Mortgage rates started 2022 with big growth — a trend that's expected to go on in April and over the balance of the year. But opportunities to lock in a low interest rate practice still exist for dwelling house buyers and refinancing homeowners.

Here are just a few strategies to keep in mind if you're mortgage shopping in the side by side few months.

Make a move before the side by side FOMC meeting

The Federal Reserve fabricated its 2022 plans very clear; it will raise the target range on its federal funds rate later on each of the year'southward remaining half dozen FOMC meetings.

It's a move the Fed makes in order to combat inflation, and mortgage rates near always grow in correlation.

Interest rates jumped after both FOMC meetings so far this year, with a 31 basis point (0.31%) surge to the average 30-twelvemonth fixed rate immediately following March'due south meeting.

While mortgage rates are famously volatile and many factors tin cause a weekly subtract, almost every indicator points to them growing over the class of the year.

If you lot're in the marketplace for a new habitation loan or a refinance — and can afford to — the best time to lock in a rate, in all likelihood, is right now. And recall, preparation is key so get all your paperwork organized and done before consulting with a lender.

Always stir contest

Interest rates are on the rise and are expected to go on going up in 2022.

The all-time way to go a skillful bargain — peculiarly now that rates no longer sit well-nigh all-time lows — is to brand lenders compete for your business organization.

Getting a qualified or prequalified rate from a lender is the first step. Then, shop that rate around to other lenders and see if any of them will offer you a amend i.

Driving competition between multiple mortgage companies is how many people end upwardly with lower rates and save coin over the life of their loan. And why wouldn't you lot want to save money?

How to compare interest rates

Rate shopping doesn't but mean looking at the lowest rates advertised online because those aren't available to everyone. Typically, those are offered to borrowers with perfect credit and who can put a downwardly payment of twenty% or more.

The rate lenders actually offer depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment (if ownership a dwelling)

- Your abode disinterestedness (if refinancing)

- Your loan-to-value ratio (LTV)

- Your debt-to-income ratio (DTI)

To effigy out what rate a lender can offer you based on those factors, yous have to fill out a loan application. Lenders will cheque your credit and verify your income and debts, then give you a 'existent' charge per unit quote based on your financial situation.

You should become 3-5 of these quotes at a minimum. Then compare them to detect the best offering.

Look for the lowest rate, just also pay attending to your annual per centum charge per unit (April), estimated closing costs, and 'disbelieve points' — extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can store for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can salvage you thousands.

Mortgage interest rate FAQ

What are current mortgage rates?

Current mortgage rates are averaging 4.xvi% for a 30–year fixed–rate loan, iii.39% for a 15–year stock-still–rate loan, and 3.19% for a 5/1 adjustable–rate mortgage, according to Freddie Mac'southward latest weekly rate survey. Your individual rate could be higher or lower than the average depending on your credit score, down payment, and the lender you choose to work with, amidst other factors.

Will mortgage rates become downwardly next week?

Mortgage rates could decrease side by side week (March 28–Apr 1, 2022) depending on how the war in the Ukraine progresses. Though rates could rise if strong inflation continues and the market adjusts to Federal Reserve'due south charge per unit hikes.

Volition mortgage interest rates go downward in 2022?

It's unlikely mortgage rates will go down in 2022. Inflation has been climbing at a record rate over the final few months. And the Fed is planning to raise involvement rates later on each of its scheduled FOMC meetings. Both these factors should lead to significantly college mortgage rates in 2022.

Will mortgage involvement rates go up in 2022?

Yes, information technology's very likely mortgage rates will increase in 2022. High aggrandizement, a strong housing marketplace, and policy changes by the Federal Reserve should all push rates higher in 2022. The simply thing probable to push button rates down would be a major resurgence in serious Covid cases and further economic shutdowns. Only, while it could help mortgage rates, no one is hoping for that effect.

What is the lowest mortgage rate right now?

Freddie Mac is now citing boilerplate 30–year rates in the high-three to depression-4 percentage range. But call back that rates vary a lot by borrower. Those with perfect credit and large down payments may become below–average interest rates, while poor–credit borrowers and those with non–QM loans could see much higher rates. You lot'll demand to get pre–approved for a mortgage to know your exact rate.

Will there be a housing crash in 2022?

For the virtually part, industry experts do not expect the housing marketplace to crash in 2022. Yes, home prices are over–inflated. But many of the gamble factors that led to the 2008 crash are not present in today's marketplace. Low inventory and massive buyer need should proceed the market propped up next year. Plus, mortgage lending practices are much safer than they used to be. That means in that location's not a subprime mortgage crunch waiting in the wings.

What is the lowest mortgage rate e'er?

At the time of this writing, the lowest 30–year mortgage charge per unit ever was 2.65 percent. That's according to Freddie Mac's Master Mortgage Market Survey, the most widely–used benchmark for current mortgage interest rates.

Should I lock my rate now or expect?

Locking your rate is a personal decision. You should do what's right for your situation rather than trying to fourth dimension the market. If you lot're ownership a home, the right time to lock a rate is afterwards you've secured a purchase agreement and shopped for your best mortgage deal. If you're refinancing, you should make sure y'all compare offers from at least 3 to 5 lenders before locking a charge per unit. That said, rates are rise. So the sooner yous tin lock in today's market, the ameliorate.

Is at present a skilful time to refinance?

That depends on your state of affairs. It's a good time to refinance if your electric current mortgage rate is above market rates and you could lower your monthly mortgage payment. It might as well be good to refinance if you tin switch from an adjustable–rate mortgage to a low fixed–rate mortgage; refinance to get rid of FHA mortgage insurance; or switch to a short–term 10– or fifteen–year mortgage to pay off your loan early on.

Is information technology worth refinancing for i pct?

It's often worth refinancing for 1 percentage bespeak, equally this can yield significant savings on your mortgage payments and total interest payments. Just brand certain your refinance savings justify your closing costs. Y'all can employ a mortgage calculator or speak with a loan officer to crisis the numbers.

How exercise I shop for mortgage rates?

Kickoff by choosing a list of 3–5 mortgage lenders that y'all're interested in. Expect for lenders with low advertised rates, great client service scores, and recommendations from friends, family, or a real manor agent. So get pre–approved by those lenders to see what rates and fees they tin offering you. Compare your offers (Loan Estimates) to find the best overall deal for the loan blazon you desire.

What are today'south mortgage rates?

Low mortgage rates are still available. Connect with a mortgage lender to find out exactly what rate you qualify for.

1Today'southward mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Involvement rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

- https://world wide web.blackknightinc.com/category/press-releases

- https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

- http://world wide web.freddiemac.com/inquiry/datasets/refinance-stats/index.folio

The data contained on The Mortgage Reports website is for informational purposes but and is non an advertisement for products offered by Total Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Source: https://themortgagereports.com/32667/mortgage-rates-forecast-fha-va-usda-conventional

0 Response to "Are Mortgage Rates Going to Increaase Again in 2018?"

Post a Comment